Opportunity

Only every once in a while is there an opportunity to make great personal gains from something

that makes perfect sense and the timing is just right!

UK brownfield investment. Why this makes sense?

These are the reasons we believe that the "UK Brownfield" proposition is a fantastic investment opportunity, right here & right now. Please take the time to watch this video presentation and see if it makes sense to you. If so, why not contact us to see how you can benefit from Investing into this exciting opportunity

Types of planning applications include:

There are various options on which to apply for planning permission to utilise and profit from valuable brownfield land.

- Residential - housing

- Commercial - shops, offices, restaurants etc.

- Mixed use - meaning residential and commercial

- Student accommodation - university cities

- Retirement or care home facilities

- Recreational - Sports & leisure facilities

UK brownfield investment. How does it work?

Time taken:

Most planning applications are decided within eight weeks, unless they are unusually large or complex,

in which case the time limit is extended to 13 weeks. Detailed drawings of the proposed site development including all environmental,

vehicular and pedestrian access, water & power requirements as well as the effects on the local community must be carried out,

and detailed reports on all of the above written and supplied with planning application.

This all takes time and typical start to finish of projects can be from anywhere between 6 & 24 months depending on size,

scope and complexity of proposed development.

Risks:

Sites are offered from various sources in various locations but ALL sites undergo a rigorous 3 stage filter process before purchase is considered. These are:- Is there sufficient financial upside potential on the proposed site within a reasonable time scale. (Optimistic initial appraisal)

- A thorough understanding of local council planning procedures and requirements, as well as any site hazards or difficulties which could potentially reduce the future value of the sales price to developers or simply take too long to complete. (Realistic & technical secondary appraisal)

- Worse case valuation of the site, can it be sold at profit in all most likely eventualities? (Conclusive and final appraisal)

The UK team members each offer different property disciplines & skill sets that acts as a natural filter and a major part of the due diligence process.

Most sites are offered off market, which means they have not been marketed for general sale as yet and many are only considered for purchased subject to certain conditional requirements being met. This not only reduces the number of sites purchased but also lowers risk considerably.

Sites purchased must also offer an excellent “fall back position” or, “plan B” to protect against future potential loss on investment. This is paramount to any site purchase and is again viewed and agreed on by all members of the selecting team.

The Opportunity:

There are various options on which to apply for planning permission to utilise and profit from valuable brownfield land.- Only every once in a while is there an opportunity to make great personal gains from something that makes perfect sense and the timing is just right! We believe that by Investing today in the regeneration of the UK’s inner city brownfield sites is such an opportunity and here is why.

- On 7th February 2017 the UK Government passed a bill making planning consent for UK brownfield sites much easier to achieve.

- The UK has a national shortage of residential housing. (Supply V Demand)

- Redevelopment of the “Northern Powerhouse” is a political priority in an attempt to narrow the North-South divide.

- It’s a “first in and first out” investment, meaning you don’t have to wait for the development, sale of all units or collection of rents to get a return on your investment.

- Rapidly growing appetite in the “Private Rental Sector” PRS from Institutional Investors.

* All UK sites are sourced and managed by a successful proven & trusted team.

All investors hold direct ownership of the asset, not investing in a fund or derivative.

Historical and expected returns on capital of *20%++ per annum.

Other Opportunity:

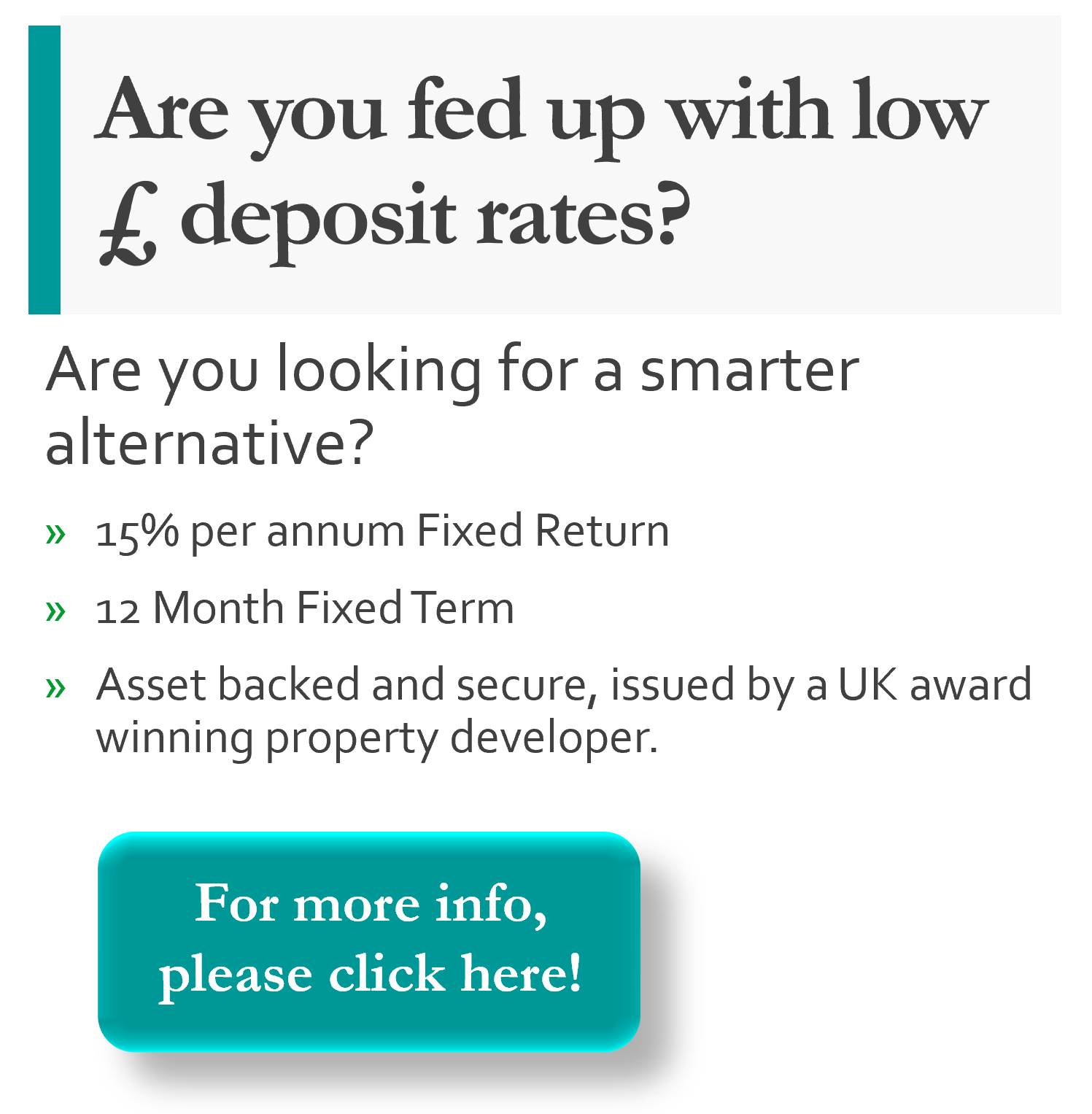

Are you fed up with low deposit rate and looking for a smarter alternative?

Please watch this video to get a better understanding of how to get a smarter althernative.